Welcome to the exciting milestone of turning 65! At Beuttel Insurance, we know this can be both a celebratory time and a moment filled with questions about Medicare. As your trusted Medicare brokers, we work with clients every day to simplify the process. Many folks we meet aren’t fully aware of key details like Medicare enrollment dates, how employer benefits coordinate with Medicare, or what it means to keep working past 65. We’re here to break it down for you with clear, accurate guidance.

Medicare Basics 101: What You Need to Know

Medicare is the federal health insurance program for people 65 and older, as well as those with certain disabilities or conditions like End-Stage Renal Disease (ESRD) or ALS. It’s made up of four main parts:

- Part A (Hospital Insurance): Covers hospital stays, skilled nursing, and hospice. Most people get this premium-free if they or their spouse worked 40 quarters (10 years) paying Medicare taxes.

- Part B (Medical Insurance): Covers doctor visits, outpatient care, and preventive services. You’ll pay a monthly premium (about $185.00 in 2025, subject to income adjustments).

- Part C (Medicare Advantage): A private plan alternative that combines Parts A, B, and often D, with extras like dental or vision.

- Part D (Prescription Drug Coverage): Covers medications through private plans.

You can also add a Medigap (Medicare Supplemental) plan to cover out-of-pocket costs like copays and deductibles not covered by Original Medicare (Parts A and B).

Who’s Eligible for Medicare?

Medicare is available to:

- Individuals aged 65 or older.

- People under 65 with certain disabilities or specific conditions like End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS).

When and How to Enroll in Medicare

Your Medicare enrollment depends on your situation:

- Already Receiving Social Security Benefits? If you’re collecting Social Security before age 65, you’ll be automatically enrolled in Medicare Parts A and B when you turn 65.

- Not on Social Security? You’ll need to actively enroll in Medicare during your Initial Enrollment Period (IEP), a seven-month window that starts three months before your 65th birthday month and ends three months after. Missing this period can result in lifelong Part B premium penalties (a 10% increase per year delayed) and gaps in coverage.

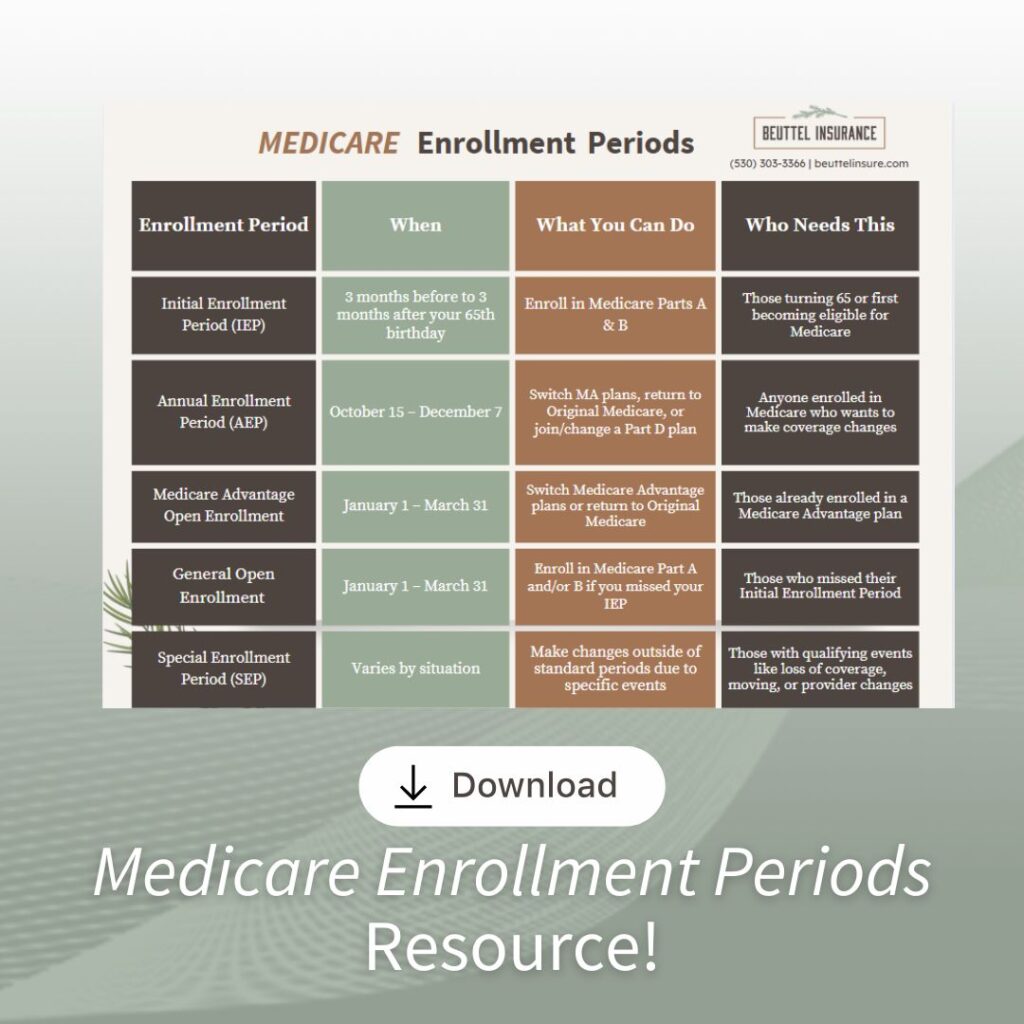

Other Enrollment Periods to Know

- General Enrollment Period (GEP): If you miss your IEP, you can sign up for Parts A and B from January 1 to March 31 each year, but coverage starts later, and penalties may apply.

- Special Enrollment Period (SEP): If you’re still working and covered by a group health plan after 65, you can delay Medicare enrollment without penalties. You’ll get an eight-month SEP to sign up once your group coverage ends.

- Medicare Advantage and Part D Open Enrollment: From October 15 to December 7 each year, you can join, switch, or drop Medicare Advantage or Part D plans, with changes effective January 1.

Since there are a few different enrollment periods with their own timelines, be sure to download the Medicare Enrollment Periods chart to help you keep track of what’s what and when you’re eligible.

What Medicare Costs in 2025

Costs vary based on your coverage:

- Part A: Usually premium-free if you’ve paid enough Medicare taxes. Otherwise, premiums can be up to $557/month.

- Part B: The standard premium is $185.00/month, with income-based surcharges for higher earners.

- Part D and Medicare Advantage: Premiums vary by plan. You’ll also have copays, coinsurance, and deductibles, which Medigap can help offset.

Reminder: Medicare costs can change each year. The Centers for Medicare & Medicaid Services (CMS) typically release updated premiums, deductibles, and coinsurance rates each fall—usually around October—for the upcoming year.

Working Past 65 and Employer Benefits

If you or your spouse are still working at 65 with employer coverage, your Medicare decisions depend on your employer’s size and benefits:

- Employers with 20+ Employees: Your group health plan is primary (pays first), and Medicare is secondary. You can delay Part B without penalty until an 8-month Special Enrollment Period (SEP) begins when employment or coverage ends (whichever comes first). Enroll in Part A at 65, as it’s usually premium-free and can work with your employer plan. Keep proof of coverage (e.g., pay stubs, W-2s) for the SEP.

- Employers with Fewer than 20 Employees: Medicare is primary, so you should enroll in Parts A and B during your IEP to avoid coverage gaps. Your employer plan may pay little or nothing if you don’t have Medicare.

- COBRA or Retiree Coverage: These don’t qualify for an SEP, so enroll in Parts A and B during your IEP to avoid penalties. COBRA typically ends when Medicare starts.

Talk to your employer’s benefits administrator to understand how your plan works with Medicare. Ask:

- Is the plan primary or secondary to Medicare?

- Will enrolling in Medicare affect my or my spouse’s coverage?

- How much are my premiums, and are they worth keeping alongside Medicare?

If you have a Health Savings Account (HSA), stop contributions 6 months before enrolling in Medicare (even Part A) to avoid tax penalties, as HSA contributions are not allowed once enrolled.

Why Work with Beuttel Insurance?

As Medicare brokers, we guide clients daily through the maze of enrollment dates, employer benefits, and working while on Medicare. We’ve seen how easy it is to miss critical deadlines or misunderstand how employer plans coordinate with Medicare, which can lead to costly penalties or gaps in coverage. Our team offers personalized, no-obligation consultations to find plans that fit your healthcare needs and budget, whether it’s Original Medicare with a Medigap plan or a Medicare Advantage plan. We are a brokerage specializing in senior healthcare, providing lifelong support and advocacy for all your coverage needs.

Medicare Enrollment: Your Next Steps!

To help you properly plan for retirement and Medicare, we’ve set up a simple ‘to do list’. Here’s your next steps:

- Contact your employer’s benefits team to clarify your coverage.

- Start planning 6–9 months before your 65th birthday.

- schedule a consultation with Beuttel Insurance.

Download our free printable Turning 65 Checklist!

Connect with our office at 530-303-3366 or visit beuttelinsure.com We’re here to help you navigate Medicare with confidence, so you can focus on enjoying the joys of retirement life.