When Your Medicare Advantage Plan Drops Your Doctor: What You Can Do Next

Many people are experiencing an unexpected drop in Medicare Advantage (MA) coverage — finding themselves without access to the care team they’ve trusted for years, often with little to no notice.

This sudden change can be overwhelming, especially when your health depends on ongoing relationships with your primary doctor and specialists who understand your history.

The Problem: More Providers Are Leaving Medicare Advantage Plans

Across the country, hospitals and doctors are stepping away from MA contracts. It’s not because they want to leave patients behind — it’s often due to issues like delayed payments, denied claims, and low reimbursement rates from insurance companies.

As a result, patients are the ones caught in the middle.

You may have been notified that your doctor, or even your entire hospital system, is no longer covered by your Medicare Advantage plan. This means you’re left to search for new providers, even though you may have spent years building a strong, trusted healthcare team.

You’re Not Alone — and You’re Not Stuck

This is happening to many people. And while it’s frustrating and disruptive, there are options available to help you stay covered and supported:

Special Enrollment Period (SEP)

If your provider leaves your MA plan mid-year, you may qualify for a Special Enrollment Period. This gives you a chance to:

- Switch to another Medicare Advantage plan that still includes your preferred doctors, or

- Go back to Original Medicare

and add a Medigap (Medicare Supplement)

policy for added coverage and provider flexibility.

Consider Original Medicare + Medigap

Original Medicare (Parts A & B) lets you see any doctor who accepts Medicare — no network restrictions. If you pair it with a Medigap policy, you can also reduce out-of-pocket costs like deductibles and coinsurance.

This option may be especially appealing if you want more freedom to choose your providers or if you’ve had issues with prior authorizations or denials under an MA plan.

Find a Better-Fit Medicare Advantage Plan

If you prefer staying on a Medicare Advantage plan, it’s worth reviewing other options in your area. Some plans have stronger networks or better relationships with local providers.

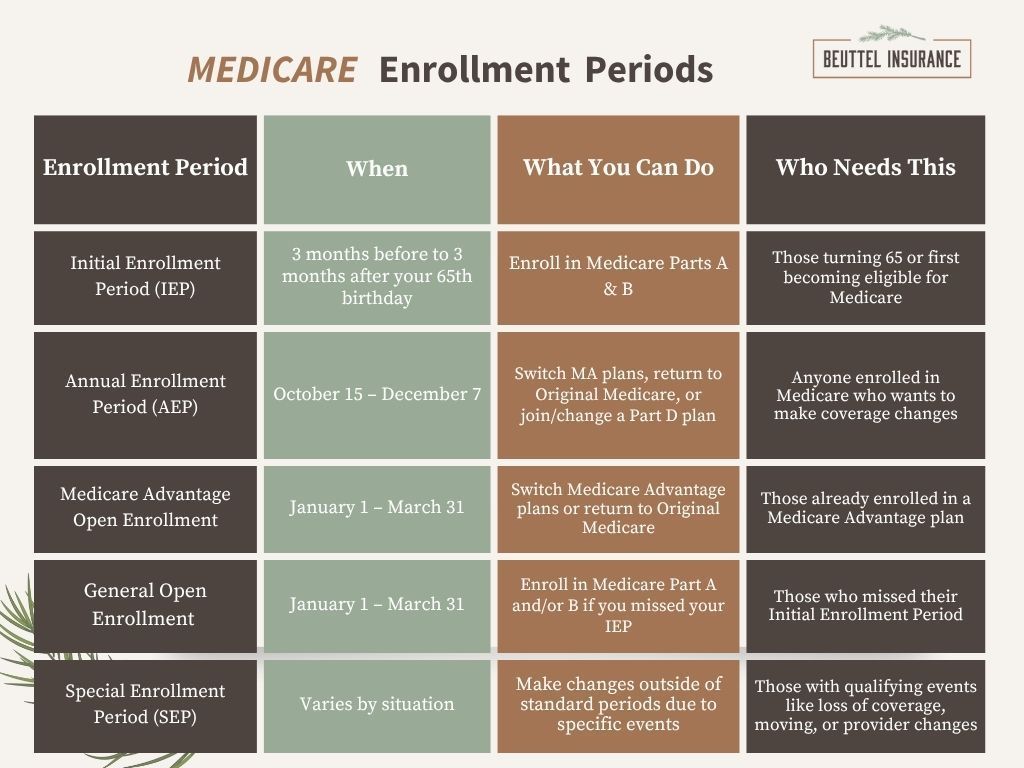

Know Your Medicare Enrollment Timeline

Why Working with a Licensed Broker Matters More Than Ever

In today’s changing Medicare landscape, having a licensed, experienced broker on your side is more than just helpful — it’s essential.

At Beuttel Insurance , we stay up to date on plan changes, provider network shifts, and special enrollment rules so you don’t have to. When your coverage is disrupted, we can walk you through alternative options , including:

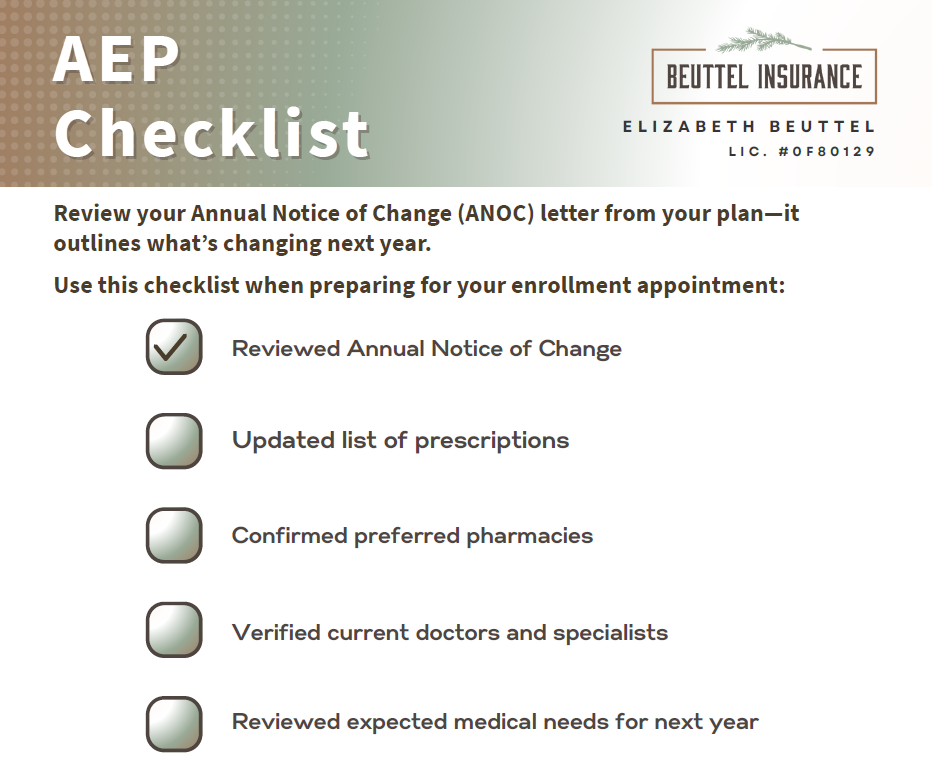

- Reviewing your current plan’s changes

- Checking for Special Enrollment Period

eligibility

- Comparing other Medicare Advantage plans

in your area

- Helping you understand whether Original Medicare with a Medigap policy might be a better fit

- Ensuring you maintain access to the care and providers you trust

Best of all, there’s no cost to work with us — and no pressure. Just personalized guidance, tailored to your health and financial needs.

You Deserve Peace of Mind with Your Coverage

If you’ve recently lost access to your doctor or hospital under a Medicare Advantage plan, don’t navigate the changes alone. At Beuttel Insurance , we’re here to help you understand your rights, your coverage options, and the best next steps.

Contact us today at 530-303-3366 or visit beuttelinsure.com — your care shouldn’t be compromised, and we’ll help make sure it’s not.

The post When Your Medicare Advantage Plan Drops Your Doctor: What You Can Do Next appeared first on Beuttel Insurance.